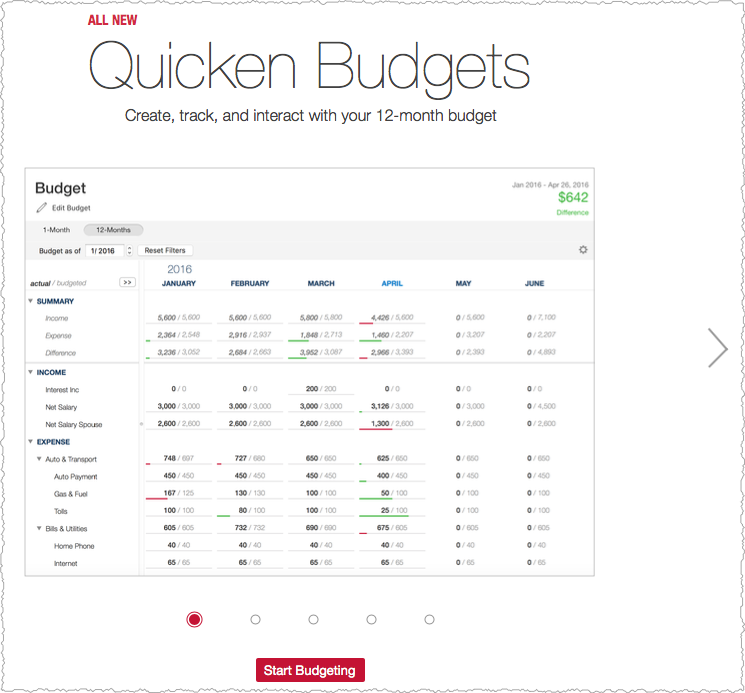

Bank feed integration: Connect your bank accounts to effortlessly track your income and spending.You can track your budget on the web or a mobile device easily. Budgeting: Plan your personal or household expenses and compare them to your actual spending.Create customized categories, track spending by categories and amounts or types of expenses, see spending trends, and get an idea of what your future finances will look like. Expense management: Understand where your expenses go by sorting your accounts and transactions in one place.Whether you’re creating a budget, managing your bills, or planning for your retirement, it has the features you need to reach your goal. Get a better handle on your household spending with Quicken’s personal finance management tools. You can customize the Home tab by creating multiple views and choosing which financial areas show up. The dashboard enables you to manage and track your budget, spending, and bills.

Your financial management journey begins on the dashboard or Home tab, which gives you a holistic view of your finances. However, since Quicken isn’t a double-entry accounting system, we weren’t able to analyze it using our rubric and, therefore, isn’t rated. A program then earns a score based on how it performs against the features we look for in a double-entry accounting system. We use an internal case study to analyze accounting software based on a set of criteria, such as pricing, features, and ease of use.

0 kommentar(er)

0 kommentar(er)